i smoked a joint with an one of those ape drawings on the jar last night, that was a Nice Fuckin Toke

Pretty much all crypto bro stuff, honestly

For me it’s usually the Bitcoin guy from the “If Google was a guy” sketches

Amazing.

We will need an immutable signature for content at some point moving forward since AI is going to be so prevalent and it will be easy to make fraudulent clips, podcasts etc. NFTs would be perfect for this.

What would be the advantage over current digital signatures?

The idea of NFT was not as much a proof of authenticity, but more like a way to sell and but those signatures.

In the context of AI I don’t see an advantage to having a easy way to sell your private key sort of speaking.

I had too much money once. I bought some nft Reddit avatars for like 2k and it is still there somewhere but I am too lazy to even check on that

It’s somewhere there some kind of nft safe they have or something like that. It’s all very clunky.

I think I had to note down some access code at some point or something like that, it’s all too tiring to remember and unclear if there is anything you can do with it

what the fuck

When they were first blowing up, I thought sure, I’ll turn a couple old unreleased tracks of mine into NFTs. I signed up to some site I forget the name of, uploaded the tracks, and then then found out I had to pay something like $500 a track to turn them into NFTs. It was a pretty duh moment for me. Of course the content doesn’t mean shit, it’s just the money. I never paid them a dime and deleted my stuff.

When I first heard of NFTs I thought the media was encoded within the blockchain - in that case sure, I wouldn’t necessarily buy one but I understand how that’d be interesting.

Ten minutes later when I was told they are just proof of purchase that points to a URL hosting your monkey image somewhere, I knew they were a total scam

Okay but how are nft’s different from the deed to a house? Checkmate, filthy commie.

Now that i have defeated you in single combat, you must tell me the seed phrase for your largest bitcoin wallet.

hunter2

Near the peak of the NFT craze I was gifted (as part of an initial mint) an NFT, which I turned around and immediately sold for $3k. Last I looked it was worth about $200. That’s the extent of my experience with NFTs.

Still surprised it’s worth $200. I thought it’d be worth a few cents or maybe a few dollars at most

It’s worth what someone will actually pay for it. I suspect that $200 is the price at which it is listed…

I see what’s going on here! You’re confusing market value labor value and use value. Typical noob mistake. Clearly ypu dont understand the real value of an nft!

Removed by mod

NFTs are great, the stupid fucking pictures that everyone calls NFTs are not

I’m not saying it doesn’t have real use cases. But I’m not aware of any useful application of that concept.

Honestly provides basically no benefits that existing token systems don’t already handle. Games have been tracking completely unique items as commodities in a large market for a long time - the only benefit new to NFT was decentralization, which basically nobody peddling them understands anyway.

The only thing it opens up is that as a game developer I can make a contract that turns NFT items from another game into NFT items of my game. Like HyperDragons that you level up by feeding them CryptoKitties, without consent or approval from CryptoKitties devs.

But why on earth, as a game developer, would you ever do that… Well, other than as a PR stunt.

The amount of ignorance regarding crypto is too damn high. I agree that NFT’s are stupid, always felt that way, but when people just say a “all crypto is a scam” really don’t understand what they are saying. There’s a plenty of legit crypto products out there, but yes, the vast majority are just garbage. Invest in the blue chips, the REAL industry of crypto, not memes or things no ones ever heard of before. (Bitcoin, Solana, Ethereum, etc…)

Solana and Ethereum are both centralized scams that have been going down vs Bitcoin for the last year, despite the bull market.

Scams with ETFs regulated by the government, audited by the government through MANY lawsuits, multiple bills being proposed to regulate the indusy… so scammy right? Legit products. Both of them. Centralization isn’t a make or break for any crypto really, they don’t have to be decentralized to be a valid product.

And price doesn’t matter at all, not sure why you even mention it. It bears nothing on the conversation at all.

lol yes absolutely they are. Yes the government is allowing legal scams. Yes scammers win lawsuits. Yes congress supports scams. A government stamp doesn’t make trusting some corporate CEO a good idea; it just means they paid the bribes.

“Blue chips” typically perform well, especially relative to their risk. You’ve got all the risks of Bitcoin, plus trust in a central party that needs government permission.

It’s a solution in search of a problem. Currencies are government backed because the vast majority of people have faith in their governments’ enforcement of legislation regarding use of that currency. It’s good to be able to make class action lawsuits against scammers and most in the population will choose anything government backed if they have the option.

So if the goal is to get away from government backing, who do you give control to? In the case of a blockchain, it’s the parties with the majority of the “proof of XYZ” creation hardware. Which are not normal people. Then there’s the possibility of developers of a blockchain choosing to rewrite the ledger, causing splits. So you didn’t invent some unmodifiable currency either, the control lies with people who you probably should trust even less than the parties managing EUR/USD.

Then, it’s incredibly energy inefficient. Especially proof of work is a ridiculous waste of computational resources, at least tie the problem to something NP-hard with actual value instead of whatever reverse hashing search is usually done. But wasting resources is the design of the system anyways.

it’s the parties with the majority of the “proof of XYZ” creation hardware. Which are not normal people.

Originally the idea was that it WOULD be normal people using their own CPU cycle time to secure the chain and mint new blocks. Even then, as long as no one party holds the majority of hash power, the incentive is to support the security of the coin rather than subvert it. The moment that changes is the moment that Bitcoin dies, because no one will be able to trust it any more - which also means there is an incentive to make sure there are enough competing BTC farms.

there’s the possibility of developers of a blockchain choosing to rewrite the ledger, causing splits.

The blockchain is upheld by the combination of the developers and the miners. If the developers aren’t acting in good faith and the miners don’t like it, they don’t move to the new chain. Sure, you get a split, but odds are one of them is going to die.

Sounds to me like you never read the Bitcoin whitepaper.

People don’t care because crypto is literally a made up thing.

Sure, people make money off of it. But people make money off loads of things. That doesn’t change that it’s literally a made up currency that has tons of people scamming the shit out of people for a quick buck.

everything that we interact with in our lives for the most part is a made-up thing

🙄

Sure bud. Act like your digital picture is the same as a painting someone made.

You know, I feel bad for the people who were conned by the Super Bowl commercials. Celebs added legitimacy to the con. Everyone else who actually got into it because of whatever other reason, I don’t give a fuck about. And SBF? Fuck that guy. I’m glad he’s in prison. (I know he was selling a crypto-currency, not NFTs. Don’t correct me.)

Oh, and the late night guy and the celeb blond lady who had an awkward conversation about it (was it the hotel sex tape lady?) can also fuck right off. Someone paid them to shill and they went for it. Assholes.

But, all that being said, I’ll sell you a jpeg for $1000. Or two for $1999.

Edit: Paris Hilton, don’t @ me. Edit: missing “the”

Removed by mod

I feel bad for people who are duped by the scam artists. But on the other hand, scam is such an integral part of the US life, recognising it is an essential skill by now. So if you have enough money to be scammed, but didn’t learn how not to get scammed, it’s at least a little bit on you at this point.

That being said, nobody is safe, unfortunately, you can be as smart and as informed as possible, they still can invent a scam that will work on you specifically.

There use to always be a crowd of TSLA stock owners (fewer now) defending Tesla in posts criticising Musk and Tesla, and similarly lots of people who are clearly cryptocurrency owners coming out of the woodworks to defend cryptocurrencies in posts critical of them.

Under this post we seem to be getting a lot of NFT owners doing the same: “selling their book” as they say in Finance.

People will say any old bollocks and dissemble like pros to keep up interest in the “investment” assets they own until they find a greater fool to dump it on.

There use to always be a crowd of TSLA stock owners (fewer now) defending Tesla

Seems like a resurgence now, plus I’m seeing a lot more misleading videos.

This time it’s worse: all scam and manipulation.

Before there were a lot of true believers and the bubble went on too long to be just a scam

How do you know a crypto scheme is a scam?

You already know, the answer is “yes”. It’s always “yes”.

The only question is, can you hold the tiger’s tail just long enough to make a mint and still let go in time that you aren’t the last one holding it.Scam or not some of them are very useful to pay for some not so legal things

Investing in currency is already dumb, in cryptocurrency? Doubly so

That’s the big question: do you recognize the scam in time to take advantage of it, and have the awareness to get out in time when there are still suckers?

I know a few people who made money on crypto in the early stages this way: recognize the scam but take advantage.

It was probably possible to take similar advantage of the Trump bribe laundering crypto scam, even without the benefit of the insider trading and market manipulation

I very briefly considered it but don’t trust my awareness to get out in time, plus participating in the scam would eat me up.

I very briefly considered it but don’t trust my awareness to get out in time, plus participating in the scam would eat me up.

Ya, one of the best pieces of advice I got was, “never gamble money you can’t afford to lose”. This is what keeps me out of trying to chase that tiger. Sure, it could be possible to make some money by jumping on one of these scams early and trying to ride sell the bump. But, it’s also likely that be the sucker losing out in the end. I’d rather not waste my money that way.

Unfortunately for them that ship has sailed. It’s not hard to get in on a scam like this of you do it early enough, i probably would have done it if i had enough money when this started (don’t judge, much, money is important when you don’t have it) and i probably would have gotten out like a bandit. Now though, it’s mostly targeting them.

Nobody is going to judge a cute and awkward baby trans girl needing cash on my watch. That’s for sure.

C-cute!? (~\\~)

Very cute and very pretty

I get the impression that most of the people who are swindled by crypto nowadays are aware of the scam and jump into it thinking they’re going to make money by finding a greater fool to dump their participation the scheme on for a profit.

Such people are really trying to be scammers in the scam.

That explains them invariably rushing to defend whatever scam token they’re holding whenever it gets criticized in social media: if outsider are generally made to suspect the true nature of the scam and hence become unwilling to jump in, these wannabe scammers aren’t going to find a greater fool to take those tokens out of their hands and give them a nice profit.

Of course as @[email protected] pointed out, these scams are done from the very start for maximum profitability of those starting the scam, not for the profit of the first ones to buy into it, so often those wannabe scammers end up being the greater fools of that scam themselves.

That’s a big part of knowing when to get out. They don’t. …… or maybe they do: I don’t know if that scam is still finding enough suckers.

You are absolutely right, just look at the popular investment subreddits, they don’t talk about long-term goals and successful investment strategies for retirement, etc. They talk about what the latest fast-buck is going to be, what the newest short or pump-and-dump is doing, they report on when a rug gets pulled or a bubble bursts so that their buddies can stop working in inflating it.

It’s an entire industry of scams and cons, from crypto to the stock-market broadly, it’s all about short-term rewards at any cost.

I used to work in Tech back in the late 90s, during the first bubble and up to the Tech Crash. I also worked in both Investment Finance and Tech Startups much more recently.

I can’t even begin to describe just how angry, disgusted and dissapointed this unholly intersection between Tech and Hyperspeculative-Finance of the XXI century makes me.

The whole spirit in pretty much the entire domain of Tech back in the 90s was completely different from this neverending bottomless swamp of crap we have in the supposedly innovative parts of Tech.

Ever since the sleazy slimeballs who saw from the first Tech bubble that there were massive opportunities to use Tech-mumbu-jumbo to extract money from suckers started (immediatly after the Crash) trying to pump the Net bubble back up (they even called it Web 2.0) that the old spirit of innovation for the sake of improving things of the old days in Tech was crushed and replaced by the most scammy, fraudulent, naked greed imaginable.

After my time in Finance (which, curiously, also involved a Crash in the Industry I was working in) I started describing Tech Startups as “The Even Wilder Wild West of Speculative Finance”.

After my time in Finance (which, curiously, also involved a Crash in the Industry I was working in)

A-ha! We’ve found the cause of the market crashes.

Joking aside, I was around for the dotcom bubble burst and the 2008 crash. Both were caused by wild speculation and we seemed to have learned nothing from them. I have little doubt we’re headed for another recession and it will again, be driven by speculation. We also have a problem with private equity (I call them “vulture equity”) which likes to capitalize on businesses which are struggling . They swoop in, buy up the company in a leveraged buyout, and then start extracting as much value from the company as possible. Usually this is in the real estate that the company owns. Once all of the value is extracted, the company is spun back off, saddled with the debt used to buy the company in the first place, and then it flounders until it ultimately collapses. This was the fate of companies like Sears or Red Lobster. Once a vulture equity company engages in a leveraged buyout of a company, that company is doomed.

Fuck. Yup. I was working in industrial automation in the late 90s, and then transitioned to network engineering at a global scale. Around 2000, the entire vibe seemed to shift. I walked out just before 9/11 and am so glad to be in an entirely different industry now.

Yeah it’s such a degeneracy……

When I worked in investments, it was all about finding the best statistical model to balance returns against risk. It was fascinating how complex the models could be, and even included currency hedging to reduce the risk of exchange rates. And most importantly to also minimize trades to control costs and tax impact. This was before lightning trading: plenty of the funds were monthly trading. Those were the good old days when a better algorithm could shave points enough to stand out but everyone was on similar footing

can you hold the tiger’s tail just long enough

The answer to this is also usually “no” because the people who set up the scamcoin usually don’t like to leave things to chance and have a plan for when to time their rug-pull.

Trying to get in on these grifts is like spotting a bank-robbery in-progress and trying to join the crew and get paid. Sure it can happen, but you’re not exactly playing with the best odds of success.

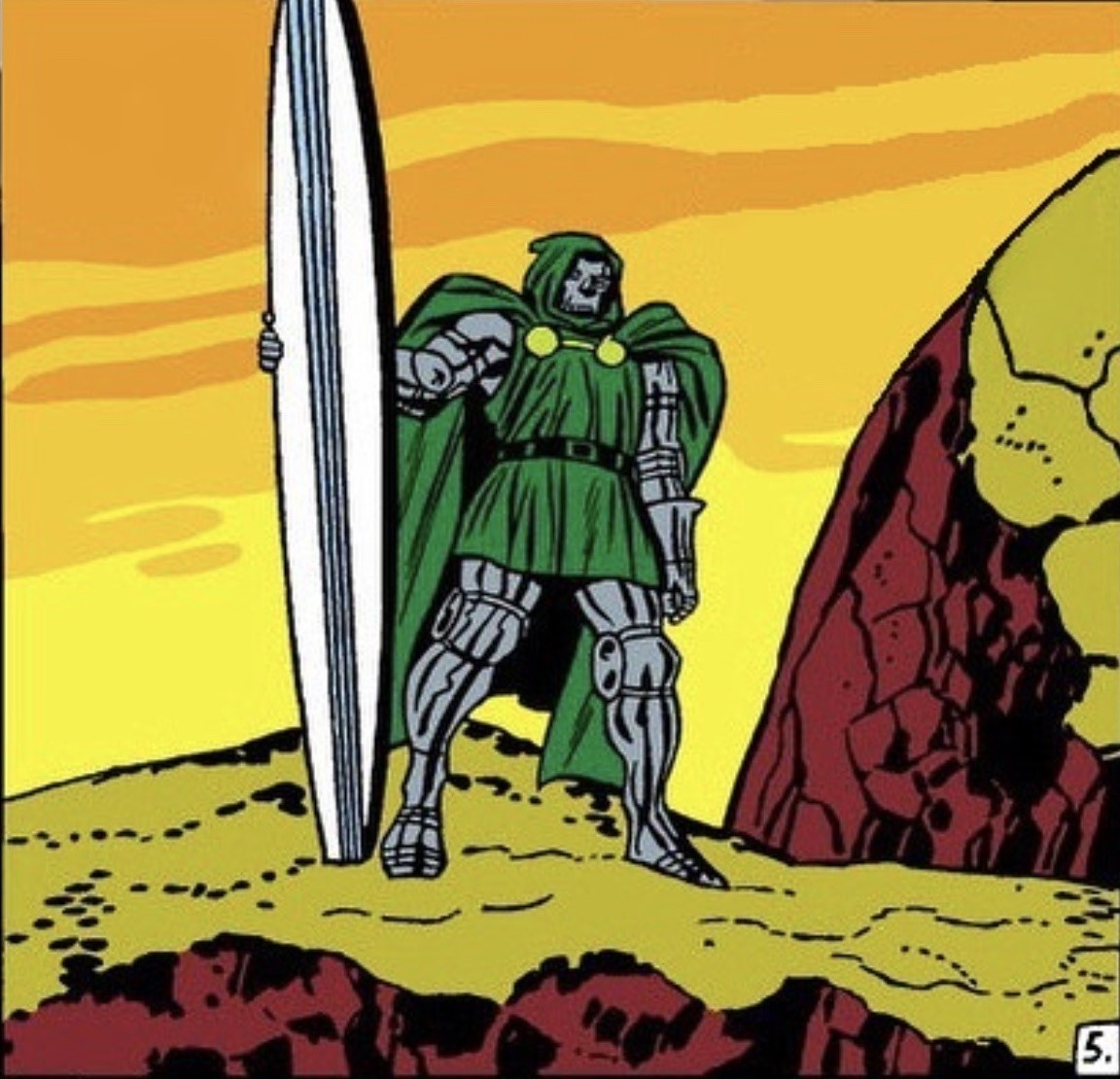

NFTs are just beanie babies for millenials and gen z

I could buy a beanie baby at an auction and then drive across town and sell the beanie baby at a different auction. I’d get around the same estimated price on the toy buying and selling, unless I found a particularly friendly/disappointing market.

By contrast, the NFT auction houses are all owned and operated by the same assholes trying to sell the digital merch. The prices are set arbitrarily, many of the sales are wash sales or straw purchases, with the same individual/cartel running multiple accounts to create the illusion of a market. Once you’ve bought your NFT, there’s no real way to off-load it onto anyone else. It’s purely a scam.

Tack on to the tail end, at the absolute worst you get a cute little stuffed animal out of Beanie Babies. With NFTs, you’re not even buying the artwork itself. You’re buying a link to artwork with no guarantee of continued costing. Quite a few NFTs are the victims of Link Rot, leading to the owner having gone out of pocket for some absurd fee in exchange for what amounts to a stall bit.ly URL.

Uh oh, you’ve offended the people who are prone to falling for scams and grifts. Across multiple generations.

I think it’s also the younger users here don’t know/remember the time when all Boomers flipped their shit and thought Beanie Babies were THE ONE TRUE investment strategy. They didn’t watch their parents blow their entire retirement fund on a scam. Instead they were the ones that actually got to play with them, so naturally they look back on them fondly.

Beanie babies were beanie babies for millennials. I still have some.

Sure, but millennials weren’t the generation that brought us things like this. They thought they could horde them to fund their kids college. I know firsthand, my mom spent hundreds of thousands on them claiming they would only go up. Now she’s got nothing. God forbid she buy a fucking savings bond.

At least beanie babies were a toy a child could play with.

Noooo! They’d lose value! (they’d go from 2 to 1.5 dollars)

Well, that’s why you get the tag protectors!

Don’t forget Funko pops

I really hate these things and can’t believe I wasted money on some my kids wanted.

But you do buy something. It’s not imaginary

A plague upon humanity.

Millenials had beanie babied wut

It’s remains sad that the name NFT is tainted by scams. In business, we start using NFTs more in various other contexts than “art”. NFT technology, without the scam marketplace, has many use cases that we only now start to see benefits from. It’s a very good way to digitize assets and use them in business processes.

Explain to me one such benefit please

Software licenses

Why would a vendor prefer that over centralized DRM that customers tolerate anyways?

For you as a user, this example can be interesting: event tickets.

Today, the market is dominated by companies like Ticketmasters and scalpers. Artists have very little control over their ticket price. Here in The Netherlands, some prominent artists started using GET to issue their event tickets on (these are technically NFTs). This gives them the assurance that the audience pays a fair price for the tickets and that scalpers cannot trade it for a higher price. Both the audience and the artist are better of using this technology, than issuing their tickets via Ticketmasters.

https://guts.tickets/ E.g. Dutch article with prominent artists starting sales via GUTS in 2018, and they still use that platform today: https://www.parool.nl/kunst-media/jochem-myjer-en-youp-van-t-hek-pakken-ticketfraude-aan~bc419f5c/?referrer=https%3A%2F%2Fwww.google.com%2F

And why do I need a Blockchain for that?

I could host my own ticket shop where tickets are only possible to check in if you have a passport and trading is impossible since it is bound to the person who bought it.

And trading can be made possible with the same platform that sells the tickets

Sure you can, but then we basically create the same situation as with Ticketmasters, all tickets will then eventually flow through your company and you can change policies again and we will end up with the same problems. With a blockchain solution (doesn’t have to be blockchain for NFT’s though) this platform can be decentralized and self managed, the rules are baked into the protocol, it can only be changed with the majority of voting rights. It basically enables the infrastructure for artists to control ticket sales (and reading at the gate) themselves, without having to use an agency. In your scenario, they would still need an agency.

You’ve heard of landlords, but have you heard of NFT-Land landlords? 🤭

“Kids, if you really want to piss off your parents, buy real estate in an imaginary place.”

Aaaaand now I have that flute part stuck in my head again

For real cash ofc.

Gonna need a bank loan, naturally.