Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

That’s how the rich get richer. They never gamble with their own money. They gamble with other people’s money, secured (hah) by their assets.

Yes a minority of us peons who are privileged enough to own property or lots of stocks can play-act like they’re rich by taking out reverse mortgages or doing options trading, but it’s nothing like what the actual rich can get away with.

Would they be able to use unrealized losses and just end up paying less in taxes then they do now?

I only make enough money to keep my family in this house and warm over the winter. But I am worth 10 billion dollars and would like a 10million dollar 💵💰 loan and forgiveness as I venture into this unknown business deal. Sounds good? Shake on it?

Ugh. It would be so much simpler to…

… Remember those memes about what you could build with a single pandemic stimulus check? From home depot?

I don’t know man, I don’t really think building millions of birdhouses will accomplish much.

/s 😉

But that means rich people will be slightly less rich. That will never happen.

Please vote for the Tax the Rich Party and not the Gut the IRS Party.

What party will actually tax the rich?

Biden also signed the Inflation Reduction Act which included IRS funds for auditing the rich.

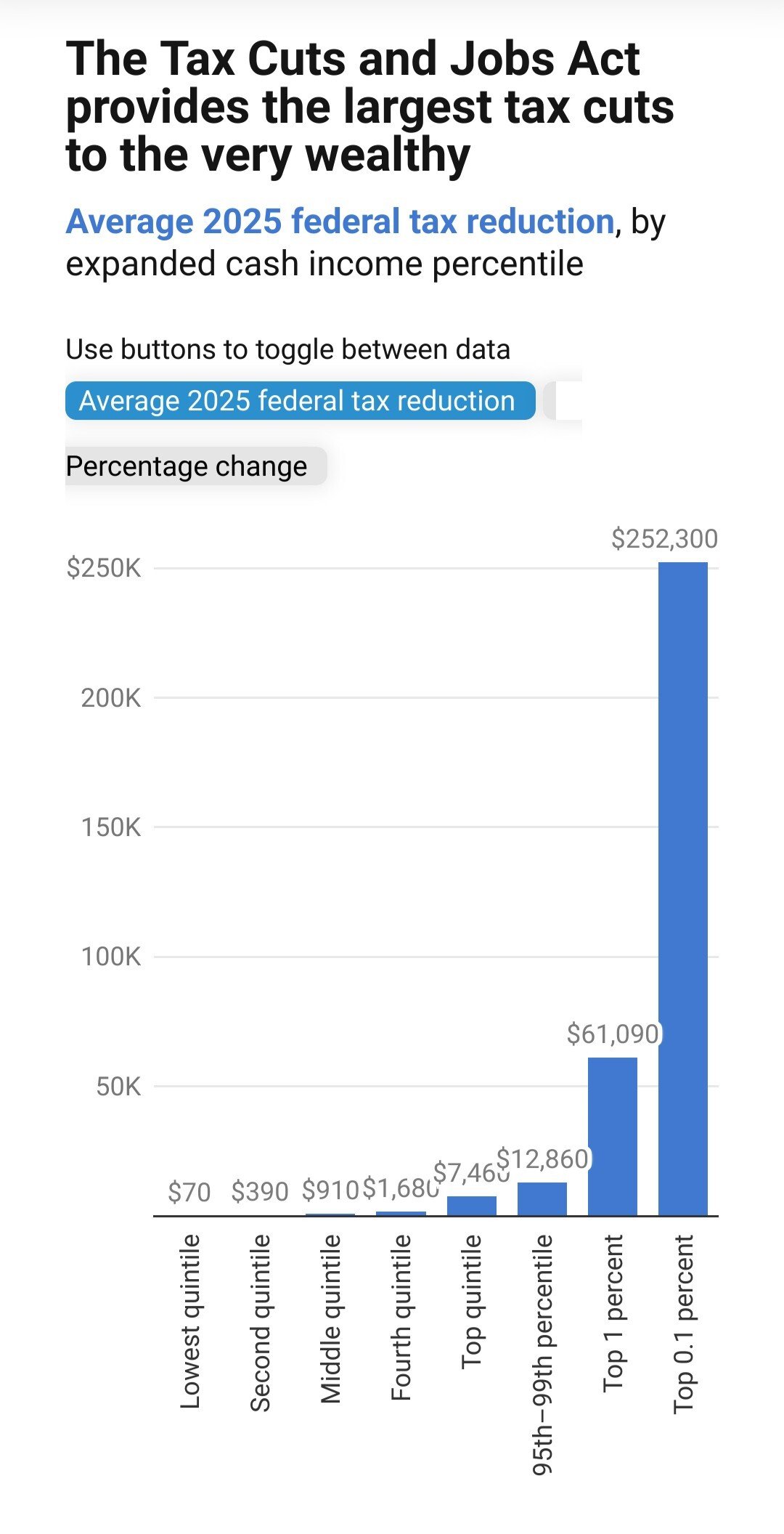

Trump’s Plan: 2016-2017 TCJA

Taxes on unrealized stock gains are fine as long as I can get my money back from the government when the stock market goes down.

Property tax is already an unrealized gain tax.

You would! Unrealized losses could be used to offset gains. If one stock goes down and another goes up, you would pay tax on the net gain, and you could take a deduction on the net loss.

The tax could also be structured so that it only applies when borrowing against the gains, so it could be rolled into the cost of the loan.

Yeah, treat tax on collateral as advance on capital gains tax

The entire market can go down. There’s no offsetting when your total value is down.

The tax could also be structured so that it only applies when borrowing against the gains

That’s fine and completely different from paying a tax on something when it has gone up but not getting the money back when it goes down.

If your total value is down, you aren’t going to be able to borrow against the gains, anyway. So no taxable event.

Let’s be clear, this is a loophole that rich people take advantage of to avoid paying taxes on income. By borrowing instead of selling, they get the profit without incurring a taxable event. It’s one of many ways capitalists siphon profit from the system while providing nothing in return.

This isn’t about borrowing against assets. I’m fine if that’s taxable.

This is about holding a stock and paying tax just for owning it despite it might be worthless when you go to sell it.

But you can already deduct losses from your taxes, up to $3,000 per year and if you have more than that, you can carry it forward. If it’s worthless when you sell, you can deduct all of the loss from your taxes.

If paying a large amount of taxes on money you didn’t make today because you can save a little money on taxes later makes sense, then I have a deal for you:

You give me $60k today and I agree to pay you back $3,000 a year until you’ve got that $60k back.

Stocks can and do frequently spike for a year or two just because the public has a fad. The stock goes back to the price you paid for it. You don’t have any losses when selling. You paid taxes on money you don’t have.

You’re just throwing random numbers around. Stocks generally aren’t that volatile, but when they do rise and fall quickly there’s usually a reason.

Like let’s say you bought GameStop stock, and it experiences extreme volatility. Let’s keep the math easy and say you start with 100 shares of stock worth $10k total, and the stock jumps to $100k. Having diamond hands, you don’t want to sell, but you owe 28% of the $90k you “made” on the stock, which can be spread out over 9 years. You sell $2,800 worth of stock this year, and you’re left with $97,200. The next year, the stock tanks to it’s original value. You have $9,720 in stock, and you have a $2,800 prepaid tax credit for whenever you decide to sell the stock. The next year, the company goes bankrupt and dissolves. You have a $10,000 loss which you can deduct from taxable income over four years, and a $2,800 tax credit.

Two things are important in this example: Such taxes only apply to individuals who have over $100 million in wealth. Nobody is going to end up poor because of the “burden” of paying a reasonable tax. The second point is that short term investments are taxed as regular income. So the example isn’t great, anyway.

In spite of those caveats, it highlights the insignificance of the additional tax burden for capitalist speculators in volatile markets. Such a tax structure discourages hoarding and market manipulation while removing the loophole that the wealthiest individuals use to avoid most taxes altogether.

Property tax is already an unrealized gain tax.

It certainly is. Now, note how the only thing akin to stocks that non-rich people can play games with the worth of is taxed. That’s because non-rich people need property as well. If property was only owned by rich people, you’d get a credit on your taxes for owning it.

Property tax is a wealth tax, not an unrealized gain tax. You still pay if your property value goes down, you just pay less.

Unrealized stock gains are companies that have been shorted into bankruptcy, so the value doesn’t change.

Could you explain what you mean? This isn’t about shorting into bankruptcy.

This is about you buying a stock in a company and it goes up like crazy (Game Stop). You now owe thousands in taxes that year. The next year it goes down to less than you paid and you need to sell the stock. You paid taxes for losing money

Investors short a company. As the value drops, the value of the short increases. When the company goes bankrupt, the short play reaches full value, since it costs 0 to buy the shares. It also means that gain is unrealized and has permanent value until the short is exercised, which they never do because it’s a taxable event.

That has absolutely nothing to do with buying a stock, it goes up crazy for a year. Then you owe a huge tax bill despite the stock being worthless the next year when you need to sell it.

Thousands of companies go up one year and go down the next. They aren’t bankrupt.

That’s an unrealized gain to the tax man, but a bank won’t loan you money against it, because like you said, it could drop to zero. If you hold a short position in a company that goes bankrupt then there’s no mechanism for the value to drop after that point. It’s a glitch in the market that can be exploited, if you’re rich enough.

Oh shit, you’re right, it’s not like we could possibly choose a specific deadline with which to tally and calculate a tax bill. That never happens for anyone.

The laws of physics just wouldn’t allow for such a thing.

I think the real solution is not to lend on fake money. Tax or no tax, it wasn’t taxes that caused the market crash in 2008.

All money is fake money, though.

The real money is the friends we made along the way who owe us favors.

That doesn’t work. It’s not enforceable.

Not enforceable as a law, but not bailing out those who do it is a great way to put an end to it.

Thank you. Even if they pass something it will be written by a bureaucratic bean counter and will be riddled with loopholes.

Simply don’t allow loans on stocks. Keep it simple.

OK. I’ll sell the stock, buy a home, then use the home equity to secure a loan to buy the stock.

That’s nothing. Late stage capitalist finance allows all sorts of ridiculous.

Ok but then you’ll pay taxes on that sale so there’s no problem.

That’s only for you humans. We corporations only pay if we net a profit. Also, if we loose money, we can carry it over to next year as a tax exemption. Good luck, ugly bags of mostly water.

Eh so… If you lose money you also can carry the tax rebate over to the next year in the US…

Yes. But, not humans. Only corporations.

The asymmetric trading rules in the US are far worse than this. And, rules enforcement for corporations is a joke.

Yes, humans as well.

Same as companies, just a different maximum amount per year and what’s left can be applied to the next year and the next and the next…

Then good luck getting a house mortgage because you can’t lend based on future income because it’s not guaranteed. When I bought my house they incorporated the value of my brokerage account. I wouldn’t be able to own a place if they didn’t.

With house mortgages it’s collateralized against the house, a physical object, but it has only a fake value until it’s actually sold because house prices can go up or down.

By pay check is unrealized gains. I still have bills to pay. Stop taxing me.

You’re not on the level of wealth this thread is about so you have nothing to worry about. Besides, your income is already taxed and in some countries it is deducted by the employer before you ever see your salary.

No shit. I’m saying its not a real gain because I haven’t deducted my living expenses like rent and groceries before my employer deducts my taxes.

I think a law stating you can’t borrow against unrealized gains would be sensible.

You can keep your unrealized gains forever, live of your dividends for all i care, and pay no tax. But realizing them, either through selling or borrowing against, triggers a taxation.

This.

Or doing so, it counts the loan as income and is taxed accordingly. But seriously, the main aim itself can also be taxed. A house is…

You’d have to put some controls in there for that solution to work. Hitting new homeowners with an immediate tax on “earning” $1,000,000 to pay for their house seems a bit cruel.

The unrealized gains is for 100 millionaires or more. I don’t think there is anyone with 100million in unrealized home value.

I was talking for a hypothetical world where that law isn’t a thing and simply paying capital gains in “realized” gains is.

Nut hey, yeah, sure, 100mil works too.

Wouldn’t that affect things like Home Equity loans?

No because the mínimum for this to apply is 100 million.

Depends on the exact implementation, but sure, you could happily write a version where an initial home loan isn’t hit, and only “top up” loans against the INCREASED value of your home is targeted.

Homes are taxes based on assessed value. They are already a form of taxes unrealized gains.

Most of the population either has:

- no unrealized gains

- gains in a retirement account that we can’t borrow against

- gains in real estate that are taxed, but can be borrowed against

- a combo of 2 and 3

I think it’s fair to ask that the rich play by the same rules. You can either borrow against your gains and pay taxes on them, or not pay taxes and not be able to borrow against them.

Seems more reasonable than taxing unrealized gains, although I’d prefer if the debate was on how to cut absurd amount of spending rather than trying to find new tax streams.

I’d rather we went back to taxing the rich properly and stopped having crumbling infrastructure.

How are you going to enforce that? The Bank can cite whatever they want for giving the loan.

If we just tax them then it’s easily enforceable and it’s done.

It can just be flipped on it’s head;

How are you going to enforce taxing on value, the person can just cite whatever value they want for the asset.

No they actually can’t. In stocks the price is publicly listed by a third party. In real estate an assessor gets involved. For commodities like cars they have to be unique or nearly so before there isn’t a third party listing it’s value.

For edge cases, especially large real estate, we could always make a second law, one that says the government can buy your building at the value you gave the IRS if it’s significantly below market rate on dollars per square foot for it’s type (office, industrial, residential, etc), or that it’s represented as a higher value in investment reports or bank loans. We’ll frame it as a bail out, helping them offload toxic assets. Then the government sells the building on the open market. That way when someone like Trump decides his buildings are suddenly worth less than all of the surrounding buildings we can keep him from going bankrupt again.

https://www.propublica.org/article/trump-fraud-ruling-property-valuation-michael-cohen

A former sitting president has been indicted, if not convicted of this very crime. You’ll have to excuse me if I don’t believe it’s that uncommon.

It took literal decades and the magnifying glass of running for public office. I’m not comfortable with that being the standard.

It is the standard. Now. Currently.

If you don’t like it, might I suggest a guillotine or several. Worked for the French.

Or, we could pass a law changing that standard.

Mhm. There’s two very good reason unrealized gains aren’t taxed: volatility and cash flow. Are you and the government expected to swap cash back and forth everyday to correct for changes in the market? No that’s silly. Should people go into debt because they don’t have the cash to pay the taxes of a baseball card they happen to own that is suddenly worth millions? Also silly.

For that same reason, using unrealized gains as security is dangerous, just like the subprime loans market was!

There’s a precise moment in time you take a loan. Use that moment in time to calculate worth; tax.

We’re talking about the stock market. And it would be quarterly or annual. Please stop exaggerating.

There’s a very good reason they should be taxed; half a dozen people are richer than god, and basically never pay any real amount of tax.

This would effectively lock out every small investor from the stock market due to the liability of both success and failure.

No it wouldn’t. The proposal out there right now has a floor of something like a million dollars. Most of us will never need to worry about that.

I mean the stock market is literally gambling, so the risk of success and failure is already there. The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan. This would only occur if you’re worth more than 100 million. You can afford to pay that tax.

I mean the stock market is literally gambling

I’ve a better record of success than the most successful poker players. Is it ten years of good luck or the consequences of effort and skill?

The proposal is whether or not we should allow people to use unrealized gains to secure loans without having to pay taxes on said gains at the point of taking the loan.

Thus locking out all non-corporate investors from margin, prerequisite to options, prerequisite to risk mitigation and gains enhancement. The average investor looses the freedom to do much more than DCA a fund.

This would only occur if you’re worth more than 100 million.

-

It’ll never be passed in such a way. Legislation always favors the corporate and wealthy as they’re the ones that write it. It’s most perverse in finance and investment. There’s been nothing favoring human investors since the breakup of Ma Bell.

-

It’s totally inadequate to save the republic from the nearly-unmitigated, algorithmically-optimized capitalism that exists today. The biggest fish, corporations, would simply get bigger by eating their biggest threat: humans with a lot of resources, but not the most affluent.

The stock market is a tool. It’s not the cause.

TL;DR:

The neolib’s proposal is crap.

This isn’t:

-

legislate away most of corporate personhood

-

restore the Glass-Steagall Act

-

repeal the Interstate Banking and Branching Efficiency Act

In no part of your response did you make any sense or a rational point, demonstrating a clear lack of understanding and a wanton disregard for good-faith arguing. Troll gonna troll I guess.

I can’t dumb it down any more. Perhaps another can do so.

-

How so?

“Oh no, I made money, better put a small percentage of my gains away for tax season, just like I do with all of my income, because I’m American and lack a good PAYE system”.

You’ve likely made a false assumption of stable value. Questions probably demonstrates best: Individuals are to pay taxes on value at what point in time? What if it was worth much more just previous to the time? What if it’s worth much less immediately after that time?

The time will probably be Dec. 31st. A small investor can get wiped out by poor holiday earnings. Or, far more likely, stocks will be artificially shorted by hedge funds in January to create the same situation. With options shenanigans and asymmetric rules, it’s trivially easy for the big fish to immediately eat everyone else.

Someone here has made a false assumption. In fact, I’m pretty sure we both have made several. The question is who has made a fatal false assumption? Let’s go.

My root comment, at the top of all of this, was my idea that perhaps we should consider gains “realized” when they are sold OR used as a collateral in a loan.

Your assertion is that it would wipe out small investors.

I would question how many small investors are using their small investments as collateral in a loan?

Anyone doing more than DCA retirement has collateralized their holdings for margin, prerequisite to options.

Good

if you secure debt against them, they should be taxed?

Yeah owning a baseball card worth money sure whatever, if you pawn that card sorry, pay taxes. You use that card a to secure a loan with lower interest rates than you’d get without then sorry, you are realizing gains whether or not you want to admit it. This goes along one of the lawsuits against Trump. He lied to get favorable interest rates by overvaluing his assets to get better interest rates. If that’s against the law why the fuck is that not counted as a “gain” to use assets to secure favorable interest rates?

Are dividends taxed?

Dividends paid out to taxable accounts are taxed.

Dividends that pay into non-taxable accounts can accumulate until they are withdrawn.

So, for instance, if you own $100 of Exxon in a regular brokerage account and $100 in an IRA, the $5 dividend you get from the first account is taxable but the $5 from the second is not.

This gets us to the idea of Trusts, Hedge Funds, and other tax-deferred vehicles. If you give $100 to a Hedge fund and it buys a stock in the fund that pays dividends, it never pays you the dividend on the stock so you never have to realize the dividend gain. You simply own “$100 worth of Citadel Investments” which becomes “$105 worth of Citadel Investments” when the dividend arrives.

I think dividends in a tax-exempt accounts, like a traditional IRA, are only not taxed if you reinvest the dividend or just leave it in your brokerage account. If you move money from your IRA account to, say, your checking account, that’s when you pay taxes (and there are generally fees for moving money out of tax exempt accounts without meeting certain conditions, like being of retirement age).

I think dividends in a tax-exempt accounts, like a traditional IRA, are only not taxed if you reinvest the dividend or just leave it in your brokerage account.

Right. Although, with a ROTH IRA, you pay taxes before you put the money in. Then you earn tax free even after you take it out. That makes it the preferable vehicle for long-term savings (you should expect your initial investment to double every 10 years, assuming a 7% ROI which is fairly modest - so over 30-40 years you’re saving 8x on the eventual withdrawal).

But this isn’t just limited to IRAs. Using investment funds, you can pull the same trick. Buy the fund, then allow the broker to shuffle the investments within the fund as they please. You only “earn” the money when you exit the fund, in the same way you only “earn” your retirement when you withdraw from your IRA.

Savings accounts and trusts can then be structured to be inheritable tax-free, with your heirs having access to withdraw from the fund without ever actually owning the money (and thus needing to pay taxes on the inheritance). And to make it even more squirrelly, you can borrow against these funds, which allows you to make large purchases without ever actually spending any money. This maneuver, plus a cagey use of declared loses, means you can avoid paying any tax on any investment income virtually indefinitely.

Thanks for expanding on the finer points! With inheritance, they also reset the cost-basis when the owner dies, which means that all the capital gains accumulated over the time that the deceased had ownership is never taxed. Like, if I bought stock for $10, die when it’s worth $100, my sister inherits it, and then sells it for $110 a while later, she only pays capital gains on $10 – not $100.

I don’t think people fully realize how dramatically our tax code rewards capital, at the expense of labor, not just in the broad-strokes (like the tax rate for capital gains vs the rates for income tax brakets) but also in these little details that are easy to overlook. So thanks for the discussion!

I largely agree with all the points made here however I think the overall message is a bit misleading. I would disagree that Roth investments are the preferred for long term investments. You aren’t accounting for the opportunity cost of the taxes paid in the initial investment year. Those taxes, while small compared to what you will withdraw tax free are also losing out on 8x-ing themselves (as you would have invested that amount in a traditional tax advantaged account).

What this means is Roth is the preferable savings method if you are in a lower marginal tax rate than you expect to be in retirement. However traditional is better if you are in a higher marginal rate than you expect to be in retirement. If the marginal tax rate was the same when you invest and retire then the difference between Roth and traditional would be nil.

You aren’t accounting for the opportunity cost of the taxes paid in the initial investment year.

If you’re maxing out your contributions, it won’t matter, except in so far as what you can earn on taxed income outside of the IRA account. That’s going to be marginal relative to the contribution. And the compound returns inside the IRA make it meaningless.

What this means is Roth is the preferable savings method if you are in a lower marginal tax rate than you expect to be in retirement.

Unless you’re going straight into a white shoe law firm or extraordinary paying tech job after you graduate, that’s pretty much everyone. But even folks going into Fortune 500 companies typically start in the $60-80k/year range and climb up from there.

If the marginal tax rate was the same when you invest and retire then the difference between Roth and traditional would be nil.

The amount of money you have in the fund is going to be much larger.

Say I invest $5000/year up front and get a 10% return for 40 years. I’m looking at putting in $200,000 over that time and taking out $2.2M.

Assuming the tax rate is 25% for each of those years, I paid $50k in taxes to invest that initial $200k. But I get the $2.2M back tax-free.

If I put the $200k in tax-deferred, I have to pay $550k to get my balance out again.

Now, we can argue that I could put the $400/year in deferred taxes into a taxable savings account. And maybe we get clever by shielding that investment from taxation annually because we just shove it all in Microsoft or Berkshire B and let it ride. That nets me another $177k over 40 years, assuming the same rate of return (for which I’m still on the hook at 15% long term gains rate - so really only $150k).

The ROTH is $350k better. That’s the whole reason the fund exists. It’s another accounting gimmick to give wealthy people a stealth tax cut. Only suckers put their money in Trad IRAs.

You seem to be using many different assumptions separately. In the first you assume you are maxing a Roth IRA (in my initial response I was also considering 401ks as many of them have Roth options nowadays). If you are maxing your Roth 401k and Roth IRA you are likely a high earner and therefore likely in a higher tax bracket than you will be in retirement. This means that kind of person will likely prefer traditional investments.

Your assumption there is someone maxing out their retirement options and in a relatively low tax bracket doesn’t seem like reality. So in your math example they wouldn’t be putting the extra in a taxable brokerage account but in the same tax advantaged account.

Quick edit: also I’m confused on the extra $400/year into taxable account. It should be $1,250 per year (25% of the 5,000) which would be closer to $600,000 before the capital gains tax.

There is a big maybe on whether Roth is better than traditional IRA/401k.

My kids are at the age where they are making those bets now. So I made a hugely complicated forecasting tool to forecast which would be better.

I think it really comes down to your view on future tax rates.

Your mileage may vary.

“Yes*”

*As with all rules, it can vary by country. As I understand it, the US tends to double tax dividends, which is a rabbit hole of why the US market chases valuation so hard

Yes

Not sure if it’s the same everywhere, but if I pull a dividend I don’t pay tax initially, but when I do my income taxes it’s part of my income and I’d have to pay tax on it then

Careful with that. If you’re not making estimated tax payments on your dividends (or other capital gains) every quarter or increasing your withholdings from wages to compensate, and you owe too much at the end of the year, you can get hit with penalties and interest.

For most people the quarterly dividends in their brokerage aren’t enough to trigger that, but as your savings grows and quarterly dividends become significant they might.

Where I’m from, we don’t do that. All dividends come with an “imputation credit,” which basically says “this money’s already been taxed.”

That was my thoughts as well.

You keep using that word, but I am not sure that you know what it means.

I am sure if net worth was based strictly on taxed earnings, most rich people would get in line to get their money taxed so that they can boast about it in their yacht owners club meetings

TBH I’m not even considered middle class where I live but I have Unrealized Gains in the form of $VYM and Bitcoin.

I think we should tax loans where stocks are used as Collateral, or set a high bar for Unrealized Gains Tax.

The bar being talked about right now is a net worth of 100million usd, do you have a net worth of 100million? If not your bitcoin is safe.

Maybe some current proposed legislature has set that bar, but this picture of a tweet does not talk about that.

That has been the baseline since the beginning. If you aren’t worth 100million there is no reason you shouldn’t support this.

There is no beginning, Unrealized Gains taxes were enforced from the founding of this nation until the late 1960s when general properties taxes in the states shifted to no longer include intangible assets, and have been a hot topic the entire time.

If you’re referring to the President’s Budget plan announced bt Biden early this spring then thats fine. But they didn’t mention it.

There’s no reason to support it if you are worth that much.

That picture is referencing Kamala’s proposed tax policy where she wants to tax unrealized capital gains on individuals worth 100mill exclusively

The tweet does not say Kamala, it does not mention “The President’s Budget” that was announced by Biden early this year, it just says that unrealized gains are not being taxed.

There is of course the implication of modern policy but I think it is healthy to include nuance and context as I have.

It’s almost like things can exist in a cultural context without explicitly defined connections.

Just say “oh, I didn’t realize” instead of digging your heels in.

Whats your problem, mate? Why is context and discussion banned in your world?

You’ll only help the liars and fiends by painting Kamala’s policy as anything other than what it is.

Says the person doing that exact thing?

Unrealized gains are the 200 push-ups Im going to do at the gym tomorrow, probably?

I wouldn’t be a huge fan of taxing unrealized gains if we hadn’t been cutting taxes for the rich for 50 years. How else are we ever going to recover from that? These guys COULD have done the right thing and supported sensible taxation policies, but they didn’t, so fuck 'em. At this point it’s either this or the guillotine.

About 70 years.

They shouldn’t be taxed because they’re just that, unrealized. They may be worth next to nothing one day. If you use them as collateral, you’re still on the hook for the value you originally took out the loan for, regardless of the loss of the investment.

This argument applies to my wages too if I elect not to be paid in USD. Are you arguing that, say, Bitcoin income should be untaxable just because it could depreciate relative to the USD tax liability it generates.

You’re getting confused between a payment & an investment. The medium in which you are paid is irrelevant. The payment is the end of the transaction and therefore is the point at which it is taxed.

No, it doesn’t.

How could you misunderstand his comment so completely?

Bitcoin is not money. You cannot file your tax return with a line-item with the number of Bitcoin you were paid. On a US tax return, you have to say how many USD you were paid. On a Canadian return, it is Canadian dollars. In the UK, it would be GBP.

If I demanded that my US employer paid me in GBP, they may do so. They would also track internally the dates they paid me, the value in USD that they paid me, and the exchange rate to GBP. The tax deducted from my check would be in USD.

This is part of the tax code in every country. You get paid in the currency of that jurisdiction ( regardless of how you choose to take payment ).

If you wanted to receive Bitcoin, it would be an investment. The taxable income would be the value on the day I received it. The value on the day that I sold is irrelevant. This is not “unrealized gains” by any stretch.

You cannot “elect” how to be paid for tax purposes. The currency on your return is a matter of law as are the rules about moving in and out of that currency. This is practically the definition of “realization”.

You can absolutely elect how to be paid, you can earn income abroad, receive benefits in kind, stock compensation etc. ALL of which may still be taxed. If your tax return only relates to dollar items, lucky you

The ignorance is strong in this one.

If you wanted to receive Bitcoin, it would be an investment. The taxable income would be the value on the day I received it. The value on the day that I sold is irrelevant. This is not “unrealized gains” by any stretch.

Then someone better tell the IRS because this is exactly how they treat crypto. And yes, people can elect to be paid in Bitcoin, I recall seeing various stories about it over the years.

Except they are realized because they are being used to purchase things and/or make more money. It can do nearly all of the things that “realized gains” can do, without being taxed.

It’s bullshit and you know it.

If they truly are “unrealized”, then sure don’t tax them. But I think we need to change the definition of that term to include the actions that OP mentioned.

“it’s bullshit & you know it” good argument. Go get an education.

That wasn’t the argument though? Look, I will give it a strikethrough and it will not change the point of my comment in the slightest.

You completely ignore the entire comment except one sentence, and then you tell me to get an education? Lol

Who’s got the shit argument again?